MIPS Member Handbook

Combined Product Disclosure Statement

and Financial Services Guide

1 July 2024 | Indemnity Insurance Policy | Membership Classification Guide

Product Disclosure Statement

Welcome to MIPS

Thank you for choosing MIPS. We are a member-based, medical defence organisation operating as a mutual on behalf of our members. We are here to protect you and your professional reputation with comprehensive insurance cover, expert advice and personalised support that we have tailored to you.

Key membership benefits

Indemnity Insurance Policy

We offer up to $20 million of cover for claims against you.

As a member, you have access to the Indemnity Insurance Policy. This cover is simple and transparent so you can be clear on what you are covered for:

Civil liability

- Clinical outcomes including diagnosis, treatment and consent

- Breach of privacy

- Telehealth consultations

Legal costs

- Regulatory and other authorities

- Employment, training and credentialing disputes

- Pursuit including defamation, indemnity and personal safety

Expert medico-legal advice and support,when you need it

We are here for you 24/7.

Protect yourself and your career with confidential and expert advice on medico-legal risks, claims, and complaints.

Cover tailored to you

We are committed to helping and supporting you when you need it most.

We understand that insurance can seem complex. Our insurance cover is tailored for the unique needs of healthcare practitioners supporting where, how, and what you practise.

Education and resources to help manage risk

We will support you with resources and CPD accredited education to help you manage risk in your practice.

We offer accredited risk education modules designed to support your professional development and enhance preparedness for unexpected events.

What is a Product Disclosure Statement?

A Product Disclosure Statement (PDS) is a document that financial service providers must provide when offering a financial services product. It will assist you in making an informed decision about whether this product meets your insurance requirements. The PDS includes information about the product’s key features, fees, commissions, benefits, risks, and the issuer’s complaints handling procedure.

This PDS is issued by the Medical Indemnity Protection Society Limited (MIPS) and sets out the insurance cover that has been obtained on behalf of its members. You should read it carefully, together with any supplementary

PDS we have provided to you, the Membership Classification Guide, and your Member Benefit Statement.

The insurance is underwritten by MIPS Insurance Pty Limited, which is a wholly owned subsidiary of MIPS, and holds a General Insurance licence with the Australian Prudential Regulatory Authority. For the avoidance of doubt, insurance is issued by MIPS Insurance Pty Ltd to MIPS, which provides a subscription to its members.

How to read the MIPS Member Handbook

As a registered healthcare practitioner, cover under this policy meets your professional indemnity obligations required by the Australian Health Practitioner Regulation Agency (Ahpra).

The MIPS Member Handbook has been designed to help you understand the professional indemnity insurance policy, and the support and cover provided.

About your membership

Find out who is eligible for membership and how we assess it, as well as information on calculating membership fees and eligibility for government premium support.

Indemnity Insurance Policy

Understand where and what you are covered for, along with exclusions, conditions and definitions for terms throughout the Indemnity Insurance Policy.

How your cover works

Get a breakdown of the specifics of medical indemnity insurance and find out why you may still want the cover we offer even if you are indemnified by your employer.

How to make a claim or notification

Understand what you need to do in the case of a claim or formal complaint being made against you, and how we are with you every step of the way.

Other information you need to know

Outlines the steps to follow in the unlikely scenario you would need to lodge a complaint or cancel your membership.

Membership Classification Guide

Ensure you have the right cover for the type of healthcare you provide and your career stage and find out what it can mean if you have indemnity cover from your employer.

Privacy Policy

We are committed to protecting the privacy of your personal information. You will find out how we collect, protect, store, and use your personal information here.

Financial Services Guide

Our financial services guide (FSG) informs you of your rights, entitlements and details the services we provide under the Indemnity Insurance Policy.

Section 01

About your membership

Who is eligible for membership?

Healthcare practitioners

All medical, dental, and nuclear medicine technologist practitioners who are registered with Ahpra are eligible to apply for MIPS membership.

Healthcare students

All students studying a course that will qualify them to become an Ahpra-registered medical, dental, or nuclear medicine technologist practitioner are eligible to apply.

What you need to tell us

By law, you must give us true, complete, and accurate information when you apply for, and throughout the course of your, MIPS membership. This includes where you provide information on someone else’s behalf.

If any of your answers are misleading, incomplete, inaccurate, or fraudulent we may reduce or not pay a claim, cancel your membership, or treat it as if it never existed.

You must notify us if you have restrictions or conditions placed on your ability to practice healthcare by a regulator or employer, or if you are stood down by your employer due to your performance or conduct.

MIPS will consider the information you provide when deciding to accept your application for, or offer renewal of, your membership.

You should also keep us informed of changes that might impact the calculation of your membership fee or classification, including changes to:

- Your Ahpra registration type.

- Your practice – including the type of healthcare you provide, your level of billings or your primary state/territory.

- The indemnity arrangement provided by your employer.

Accepting and renewing your MIPS membership

Acceptance of new members and renewal of MIPS membership is subject to an assessment of eligibility based on underwriting criteria.

Invitations to renew membership are issued annually.

We may refuse to offer or renew your membership, offer you membership with a risk surcharge and/or other special conditions, reduce your claim, or cancel your MIPS membership.

This can occur if you:

- Fail to comply with the duty of the utmost good faith or make misrepresentations when applying for MIPS membership.

- Fail to pay your MIPS membership fee.

- Fraudulently claim under the policy.

- Practise in a way that poses an unreasonable risk of substantial harm to the public or patients.

- Pose an unreasonable risk of harm to MIPS staff.

- Fail to comply with this policy.

- Practise in breach of a condition, restriction or undertaking on your Ahpra registration, or imposed by us.

Getting the right cover for you

Your cover is determined by the type of healthcare you provide. It is important that you tell us about the full scope of healthcare services you deliver including your qualifications, training, and experience, requirements for supervision where relevant and the state or territory of your practice. You must also tell us the extent to which the healthcare you provide is indemnified by your employer. Using this information, we will assess and advise you of your MIPS membership classification.

Note, any healthcare provided outside your membership classification will not be covered automatically under the Indemnity Insurance Policy. Some of the healthcare you provide may also need an endorsement before you are covered. Please refer to the ‘Membership Classification Guide’ section of this handbook for further information.

If you are an existing member, you can find your current classification information on your Member Benefit Statement.

Your membership fee

Your membership details, as shown on your Member Benefit Statement for the current and three prior policy periods, are used to calculate your individual membership fee. This means your membership fee responds to how your practice changes over time.

The following factors are considered when calculating your membership fee:

- Your category and practice basis.

- Your estimated annual gross billings and/or salary or hours worked for practice that is not employer indemnified.

- Whether your type of practice requires an endorsement e.g. Minor cosmetic services, Spinal surgery or Bariatric surgery.

- The state/territory you practise in.

- Your retroactive cover date.

- Your claims history.

- Any specific factors that impact your risk.

- Any loadings including a risk surcharge. If applicable, the risk surcharge will be calculated in accordance with the ‘Medical Indemnity Act 2002 (Cth)’.

A minimum membership fee may apply.

Your membership fee can be paid in full by the due date, or by monthly direct debit instalments. To opt in for direct debit, complete the Direct Debit Instalment Request at mips.com.au/forms

Your Member Benefit Statement

If you join MIPS or if your membership is renewed, we will issue you a statement that contains your membership benefits (including insurance cover), your membership details, and any special conditions on your cover (if applicable). If any details are incorrect, contact MIPS on 1800 061 113 (from outside Australia +61 3 8620 8888) or info@mips.com.au

Fee support through the Premium Support Scheme

The Premium Support Scheme (PSS) is an Australian Government initiative designed to help eligible doctors with the costs of their medical indemnity insurance. MIPS administers our members’ applications for the scheme on behalf of the government. If you are eligible, you will receive a subsidy under the PSS.

To apply for the PSS subsidy, complete the Premium Support Scheme (PSS) Application online at mips.com.au/forms. For more information visit the Department of Health and Aged Care website. If you apply for the PSS subsidy, the relevant details will be outlined on your Member Benefit Statement.

How we deliver the support we promise

We take our responsibility to protect your reputation seriously. We ensure we have the financial resources and capabilities to meet our obligations to you. Our financial position is outlined in our annual reports, available at mips.com.au/about-us/member-reports

Section 02

Indemnity Insurance Policy

About this Policy

Depending on your membership classification, this Policy can include cover for civil liability claims for up to $20 million, which allows You to meet your registration requirements as a Healthcare Practitioner in Australia. This section describes the coverage of the insurance that MIPS has obtained for its members.

Subject to its terms and conditions, and Your classification, this Policy can provide the following cover for Claims arising from Your provision of Healthcare:

- Civil liability Claims, such as when You are sued and require legal representation to defend Yourself and/or are required to pay compensation.

- Legal Costs of defence and representation for investigations, proceedings, and other types of disputes.

- Legal Costs for certain types of employment and pursuit matters.

Important Information

When reading this Policy, You should also refer to Your Member Benefit Statement which will state whether Your cover is subject to any special conditions, including excesses.

What we cover

- When You are insured

- You are insured under the terms set out in this Policy and Your Member Benefit Statement, whilst You are a current member of MIPS.

- We will cover You if the Incident is notified to Us in the Policy Period, but only for matters arising from Healthcare occurring on or after Your Retroactive Cover Date.

- We cover You for Healthcare You provide which includes Gratuitous Services and Good Samaritan Acts as specified within this Policy or as agreed in writing by Us.

- Where You are insured

- This Policy applies to Healthcare You provide within Australia.

- You are not covered for Healthcare You provide in the United States of America (USA) or anywhere USA law applies (except for Good Samaritan Acts, which are covered worldwide).

- In all other circumstances, You are only covered for Healthcare You provide outside Australia where it is:

- for no more than 120 days in aggregate within the Policy Period; and

- in accordance with applicable laws and regulations for registration in that country; and

- with appropriate local insurance cover in place (if this is required); and

- in the following circumstances:

- gratuitously as a volunteer for a charitable organisation or for disaster relief work; or

- where you are the official team doctor accompanying members of an Australian sporting team or cultural group performing or

participating in a competition and to people travelling with them such as coaches or family members, but You are only covered with respect to Claims against You by members of that team or group who are Australian residents; or

- as part of a clinical placement, rotation or fellowship that is approved by an Australian Medical Council (AMC) accredited college for the purpose of qualifying as

a specialist medical or dental practitioner in Australia, but only where You are insured for civil liability outside of Australia by Your employer or

- as specified under ‘Telehealth consultations’ or ‘Medical retrievals and repatriation’; or

- agreed to by Us in writing.

- You must notify Us in advance of Your travel if You intend to provide Healthcare outside Australia.

- How much We will pay under this Policy

- The maximum amount We will pay under this Policy including Legal Costs is $20 million for one or more Claims in the aggregate, notified by You in the Policy Period (reduced by any applicable excesses).

- The maximum We will pay is subject to the sub-limits set out in the table on the next page. Where there is no sub-limit, You are covered for the amount set out in Clause 3.1.

| Area of Cover | Clause/s | Sub-limit* |

| Civil liability | ||

| Adverse clinical outcomes | 4 | No sub-limit |

| Breach of privacy | 5 | No sub-limit |

| Telehealth consultations | 6 | No sub-limit |

| Supervising others | 7 | No sub-limit |

| Reporting others | 8 | No sub-limit |

| Clinical trials and research projects | 9 | No sub-limit |

| Medical retrievals and repatriation | 10 | No sub-limit |

| Human rights or equal opportunity complaint | 37 | $15,000 |

| Professional and disciplinary matters | ||

| Regulartory processes | 11 | No sub-limit |

| Coronial and other public inquiries | 12 | No sub-limit |

| Criminal matters | 13 | $500,000 |

| Medicare investigations and audits | 14 | No sub-limit |

| Other billing investigations and audits | 15 | No sub-limit |

| Removal from proceedings | 16 | No sub-limit |

| Statutary breaches | 17 | No sub-limit |

| Mandatory reporting | 18 | No sub-limit |

| Employment, training and university disputes | ||

| Employment contracts and credentialling disputes | 19 | $100,000 combined sub-limit |

| Workplace bullying or harassment | 20 | |

| Training program, professional association and university disputes | 21 | |

| Pursuit matters | ||

| Defamation pursuit | 22 | $150,00 ($20,000 excess^) |

| Pursuit of indemnity | 23 | No sub-limit |

| Personal safety pursuit | 24 | $100,000 |

| Pursuing an objection to a subpoena | 25 | No sub-limit |

| Removal of restrictions on registration | 26 | No sub-limit |

| Additional cover | ||

| Sole Practitioner entity and Practice Staff | 27 | No sub-limit |

| Contagious disease | 28 | $25,000 |

| Cover for students | ||

| Student members | 29 | As above |

^The excess of $20,000 reduces the amount payable by MIPS under the sub-limit from $150,000 to $130,000.

Civil liability

We will cover You for Your legal liability as a result of a demand for compensation, including Legal Costs, in relation to Claims of the following nature made against You for an actual or alleged negligent act, error, omission or circumstance arising from Your provision of Healthcare:

- Adverse clinical outcomes

- That result in physical or psychological harm to, or the death of, Your Patient (or dependent parties).

- Breach of privacy

- Any actual or alleged breach of a duty of confidentiality that is owed to a Patient, or the contravention of any provision of the ‘Privacy Act 1988 (Cth)’, or equivalent legislation in connection with Your provision of Healthcare.

- We will not cover You with respect to:

- any breach of privacy which occurs or continues after You knew, or reasonably ought to have known that You would contravene the ‘Privacy Act 1988 (Cth)’ or equivalent legislation; or

- any breach of privacy which occurs in relation to a criminal Cyber Act or Cyber Incident; or

- any breach of privacy relating to clinical trials or research projects; or

- any civil, statutory, or pecuniary penalty or fine that You agreed, or are ordered or directed to pay.

- Telehealth consultations

Unless otherwise agreed in writing by Us, Telehealth is only covered where:

- it is provided in accordance with any Telehealth-related guidelines and requirements of Ahpra that were in force at the time of the Telehealth consultation; and

- at the time of the Telehealth consultation:

- You and the Patient were in Australia; or

- You were outside of Australia, but only if You had been outside Australia for less than 120 days in the aggregate during the Policy Period and the Patient was in Australia at the time the Healthcare was provided; or

- the Patient had been outside Australia for less than 90 days and You were in Australia at the time the Healthcare was provided; and

- neither You nor the Patient were in the USA or anywhere USA law applies.

- In the case of the use of Asynchronous Telehealth:

- there was a pre-existing real-time clinical relationship between You (or a doctor from Your practice) and the Patient; and

- there is the capability to see and/or hear the patient in real time.

- Supervising others

- Where You are observing, supervising, mentoring, or teaching another person providing Healthcare; or

- restricting another person whom You are observing, supervising, mentoring, or teaching, from practising Healthcare.

- Reporting others

- Arising directly out of You reporting an Incident or reporting the health, conduct and/or performance of another Healthcare Practitioner to a regulator, hospital, area health authority, or professional body;

or participating in the review of the Incident or Healthcare Practitioner; and - where You were acting in good faith and in accordance with Your professional responsibilities, or You were required

to do so by law (including a demand for compensation against You alleging defamation).

- Arising directly out of You reporting an Incident or reporting the health, conduct and/or performance of another Healthcare Practitioner to a regulator, hospital, area health authority, or professional body;

- Clinical trials and research projects

- Where You undertake a clinical trial or research project and:

- ethics approval was obtained from a Human Research Ethics Committee registered with the National Health and Medical Research Council; and

- You only treated research participants located within Australia; or

- it was agreed to by Us in writing; but

- not where the Claim arises from activities that are outside the scope of the approval provided by the ethics committee.

- Where You undertake a clinical trial or research project and:

- Medical retrievals and repatriation

- Where You undertake a medical retrieval and repatriation where:

- the Patient was repatriated into Australia; and

- the repatriation occurred anywhere in the world, excluding the USA or where USA law applies; unless

- it was agreed to by Us in writing.

- Where You undertake a medical retrieval and repatriation where:

Professional and disciplinary matters

We cover You for Legal Costs that We incur on Your behalf or that You are ordered to pay, in relation to the following types of matters, arising from or in connection with Your provision of Healthcare:

- Regulatory processes

- Defending or responding to complaints, notifications, investigations, audits, hearings, proceedings, or inquiries that:

- may be brought before or managed by a registration board, tribunal, court, complaints entity, employer, or workplace (including a hospital), government department (including Drugs and Poisons Units), statutory authority, private authority or similar; and

- relate to Your health, conduct, performance or compliance with rules, regulations, laws, guidelines or codes of conduct in relation to Healthcare provided by You.

- In relation to Clause 11.1, We will not cover You:

- for any costs incurred in complying with directions or orders made, conditions, undertakings, or restrictions imposed by any body; or

- in relation to or any costs or repayments arising from audits undertaken by the Australian Tax Office, or a State or Territory Revenue Office(s).

- Defending or responding to complaints, notifications, investigations, audits, hearings, proceedings, or inquiries that:

- Coronial and other public inquiries

- Defending or representing You, or responding to, a coronial inquiry, investigation, inquest or a commission of inquiry (including a Royal Commission) in Your capacity as a Healthcare Practitioner.

- Criminal matters

- Defending or responding to a criminal allegation, charge, investigation or proceeding arising directly from Your provision of Healthcare, but only where You:

- deny the allegation and/or charge, or You have not admitted guilt

and/or pleaded guilty; and

- have not been found or determined to be guilty of a criminal act by a court.

- deny the allegation and/or charge, or You have not admitted guilt

- We reserve the right to recover all Legal Costs paid in connection with the criminal matter if You admit guilt or are found guilty.

- Defending or responding to a criminal allegation, charge, investigation or proceeding arising directly from Your provision of Healthcare, but only where You:

- Medicare investigations and audits

- Defending or responding to an audit, investigation or proceeding initiated by Medicare or the Professional Services Review, including responding to a notice, investigation, or complaint that is related to an allegation of inappropriate practice

within the meaning of the ‘Health Insurance Act 1973 (Cth)’ and brought under that Act.

- This includes assistance negotiating an agreement, but excludes any repayments You are ordered to make or that You agree to make, to Medicare, the Pharmaceutical Benefits Scheme, the Professional Services Review or other government body.

- In relation to Clause 14.1, We will not cover You where You have acted fraudulently.

- Defending or responding to an audit, investigation or proceeding initiated by Medicare or the Professional Services Review, including responding to a notice, investigation, or complaint that is related to an allegation of inappropriate practice

- Other billing investigations and audits

- An investigation by the National Disability Insurance Scheme (NDIS), the Department of Health, a private health insurer, worker’s compensation insurer, or motor accident compensation scheme, in relation to billing for Healthcare You have provided.

- In relation to Clause 15.1, We will not cover You for any repayments You are

required to make, or where You have acted fraudulently.

- Removal from proceedings

- To remove You from the proceedings in which You have been named due to

Your association with another Healthcare Practitioner or other entity for Healthcare You did not provide or supervise, or for which another entity is vicariously liable.

- To remove You from the proceedings in which You have been named due to

- Statutory breaches

- Defending a complaint in relation to a breach of workplace health and safety law, environmental law, consumer protection law or privacy law.

- This does not include cover or payment of fines or statutory/civil penalties.

- Mandatory reporting

- Defending a complaint against You that arises from You carrying out a mandatory reporting obligation.

Employment, training, and university disputes

We cover Legal Costs that We incur on Your behalf, or that You are ordered to pay, in relation to the following Claims connected to Your provision of Healthcare:

- Employment contracts and credentialling disputes

- We provide cover to pursue or defend an Employment Dispute:

- with Your former/current/prospective employer or any other person by whom You were/are/will be engaged as a Healthcare Practitioner that relates to the contract/proposed contract by which You were/are/will be engaged as a Healthcare Practitioner; or

- arising from a contract or proposed contract between a hospital or health service and You relating to Your engagement as an independent contractor or visiting medical officer.

- In relation to Clause 19.1

- We will only pay/incur, or continue to pay/incur, Legal Costs of pursuing any complaint where legal advice shows there are reasonable prospects of success.

- In relation to any Claim by You for unpaid remuneration or other monies, We will not pay Legal Costs greater than the amount reasonably sought by You in that Claim, unless We receive legal advice that there are reasonable prospects of recovering those costs, in whole or in part, from the other party.

- Where You are a Sole Practitioner,

- defending an Employment Dispute with Your former/current/prospective employee or contracted staff member that relates to the contract or proposed contract under which the employee or staff member was/is/or will be engaged; to assist You in Your practice as a Healthcare Practitioner.

- We provide cover to pursue or defend an Employment Dispute:

- Workplace bullying or harassment

- Pursuing a complaint where You are a victim of workplace bullying or harassment where Your employer/workplace is unable or unwilling to assist.

- In relation to Clause 20.1, We will only pay/incur, or continue to pay/incur, Legal Costs of pursuing any complaint where legal advice shows there are reasonable prospects of success.

- Training program, professional association and university disputes

- Defending a complaint, responding to an investigation, or pursuing a right of appeal that relates to:

- Your involvement in a training program approved or recognised by an AMC accredited college; or

- a dispute arising from Your membership with a professional association or an AMC accredited college; or

- a decision of a university where the university course or degree that You undertake is a requirement for qualification as a registered Healthcare Practitioner, or is a requirement of Your specialist training program.

- Clause 21.1 will only apply where:

- it is alleged You have engaged in misconduct; or

- You have not been afforded procedural fairness, or were subject to unlawful discrimination.

- Clause 21.1 will not apply in matters relating to recognition of prior learning.

- Defending a complaint, responding to an investigation, or pursuing a right of appeal that relates to:

Pursuit matters

We cover Legal Costs for pursuing the following matters in relation to the Healthcare You provide, but only where legal advice shows that there are reasonable prospects of success:

- Defamation pursuit

- Where a person (a Patient or another person acting on behalf of the Patient) defamed You in connection with Your provision of Healthcare.

- You must obtain Our consent, which will not be unreasonably withheld, before commencing any proceedings.

- This cover is subject to a $20,000 excess payment for each separate pursuit of one or more defamation allegations.

- We will not cover You for an allegation of defamation that occurred outside of Australia or against a person who is a healthcare professional.

-

Pursuit of indemnity

- Pursuing indemnity cover on Your behalf, where Your employer, other insurer or any body through which You have a contract of insurance (other than through this Policy), has declined to assist or indemnify You.

-

Personal safety pursuit

- Pursuing a personal safety protection order, intervention order (or equivalent) in a Court (or equivalent), where there is a threat posed to the personal safety of You, or Your immediate family, by another person in connection with Your provision of Healthcare.

- This cover extends to Your Practice Staff when You are a Sole Practitioner.

-

Pursuing an objection to a subpoena

- Assisting and representing You in objecting to a subpoena, summons or similar court order to produce Healthcare records or attend court, where there are reasonable grounds to challenge the order.

-

Removal of restrictions on registration

- Assisting and representing You in an application or request to a registration body to remove restrictions on Your Ahpra registration.

-

Assistance and representation under Clause 26.1 will only be provided where:

- We believe there are reasonable grounds to request the removal; and

- the restrictions that were imposed on Your registration arose from a Claim that was accepted by MIPS.

Additional cover

- Sole Practitioner entity and Practice Staff

When you are a Sole Practitioner:

- We will cover You and Your practice, including while You are replaced by a locum/temporary Healthcare Practitioner for sick or recreational leave.

-

Your Practice Staff are covered for Claims made against them by Your Patients:

- when they were acting under Your instruction, direction or supervision or otherwise supporting You in Your provision of Healthcare; but

- only in relation to Claims under Clauses: 4-6, 16, 17 and 23 of this Policy and only in relation to their administrative work.

-

We will not cover Your Practice Staff under this Policy for Claims arising out of or in connection with:

- cosmetic or anti-ageing treatment, therapies or procedures performed by them; or

- their provision of Healthcare which requires them to hold registration with Ahpra.

Important note: If You do not qualify as a Sole Practitioner You may consider whether You need a separate practice entity policy to cover Your practice and actions of Your staff. Contact MIPS for information about this cover.

-

Contagious disease

-

If You are first diagnosed during the Policy Period with Human Immunodeficiency Virus (HIV), Hepatitis B, Hepatitis C, Extremely Drug-Resistant Tuberculosis (XDR TB), Multidrug-Resistant Tuberculosis (MDR TB) or New Delhi metallo-enzyme enterococci (NDM-1) We will pay You $25,000 if You:

- retire due to disability; or

- significantly revise Your practice or significantly train or re-train to enable You to continue to practise Healthcare.

- If We make a payment to You under Clause 28.1, Your cover under this clause will cease and will not be reinstated in a subsequent Policy Period.

-

This cover does not apply:

- where you notify us more than 24 months after You knew or ought to have reasonably known about Your diagnosis; or

- if You are diagnosed within three months of Your Commencement Date; or

- if You refuse to undergo any tests which We reasonably request to verify the diagnosis, or if such tests do not verify the diagnosis.

-

If You are first diagnosed during the Policy Period with Human Immunodeficiency Virus (HIV), Hepatitis B, Hepatitis C, Extremely Drug-Resistant Tuberculosis (XDR TB), Multidrug-Resistant Tuberculosis (MDR TB) or New Delhi metallo-enzyme enterococci (NDM-1) We will pay You $25,000 if You:

Cover for students

-

Student members

-

If You are a Student Member We will only insure You:

- under Clauses: 1-5, 8, 11-13, 16, 18, 20,21, 23-25 and 28 of this Policy; and

- under Clause 9, but only when Your assistance or involvement in research is a requirement of Your university course or qualification; and

- where You were appropriately supervised by a suitably qualified Healthcare Practitioner; and

- where You were provided adequate access to communication, oversight, interaction, direction and support from Your supervisor throughout the provision of Healthcare.

-

If You are a Student Member We will only insure You:

What we do not cover – general exclusions

We will not cover You, Your practice or Your Practice Staff under any section of this Policy, for Claims arising out of, or in connection with the following:

-

Prior Incidents

- an Incident that occurred before Your Retroactive Cover Date; or

-

an Incident that occurred before the Policy Period, about which:

- You knew or ought to reasonably have known; and

- You either notified Us or failed to notify Us before the Policy Period commenced; or

- You notified, or it would have been reasonable and feasible to have notified another insurer/indemnifier before the Policy Period commenced.

- Breach of registration, conditions, lack of qualifications or appropriate facility

Unless in relation to an emergency, Healthcare provided by You:

- while You are not registered to practice or do not have the appropriate and recognised registration, training, qualifications and/or experience to provide that Healthcare (including without required supervision) and/or supervision of the Healthcare provided by others; or

- that is in breach of any conditions or restrictions imposed on You or Your practice (whether by consent or otherwise) by Ahpra, any registration or regulatory body, any court/tribunal, Your employer, an educational body, Healthcare facility, supervisor or MIPS; and

- that gives rise to a request for indemnity under this Policy due to a breach of any specific conditions, or restrictions imposed on You or Your practice, by any registration or regulatory body, Your employer, educational body, Healthcare facility or supervisor; or

- in a facility or organisation that does not hold appropriate accreditation and/or licensing, or where You are aware that the facility does not have appropriate access to resources for the Healthcare You provide.

- Clauses: 31.1-31.4 also apply to any Gratuitous Services You provide.

- In relation to Clauses: 31.2 and 31.3, conditions or restrictions imposed in Australia will be deemed by MIPS to apply to Your practice outside of Australia.

-

Sexual misconduct

- Sexual harassment, sexual touching, sexual assault or sexual misconduct by You.

-

Legal Cost cover is provided to You only in relation to such Claims under Clauses 11 and 13, when there is no:

- factual finding or determination by an Adjudicative or Determining Body that upholds any allegations of a nature outlined in clause 32.1, or

- admission of guilt or concession by You of any of the facts that could give rise to an adverse finding or determination, or

- charge of sexual assault that arises from an allegation brought by a Colleague.

- In relation to Clause 32.2, We reserve the right to recover from You all Legal Costs paid in connection with any Claim under Clause 13 from the point at which an adverse finding, determination, admission or concession is made, or a relevant charge is brought.

What we do not cover – civil liability exclusions

We will not cover You, Your practice, or Your Practice Staff for civil liability (including associated Legal Costs) under this Policy arising out of, or in connection with the following:

-

Outside of Australia

- Proceedings, judgements or orders by a court, or other body against You, brought or held outside of Australia, or where laws of another country apply.

- Exclusion 33.1 does not apply if the requirements of Clause 2 are satisfied.

- Outside of Membership Classification Guide or regular practice

Unless agreed by Us in writing or in relation to an emergency, Healthcare provided:

- that is not included in Your membership classification or specifically endorsed and stated on Your Member Benefit Statement (unless the act was a Good Samaritan Act); or

- which is not normally associated with Your category; or

- includes elective procedures You have carried out on family members; or

- involves Your provision of services to a pharmaceutical, medical device/implants or technology company; or

- is alternative or complementary Healthcare that is not provided in accordance with relevant AMC-accredited college or professional association guidelines; or

- includes cosmetic procedures except where specifically included in Your membership classification as described in the Membership Classification Guide or endorsed on Your Member Benefit Statement; or

- whilst You were under the influence of any substance that impairs Your ability to provide Healthcare; or

- which meets the definition of inappropriate practice within the ‘Health Insurance Act 1973 (Cth)’; or

- in a facility (or for an organisation) that does not hold appropriate accreditation or licensing (if required).

-

Defamation

- For defamation, libel or slander committed or allegedly committed by You, other than when arising from Clause 8.

-

Criminal and dishonest acts

- Any reckless, wilful or dishonest act, omission or conduct (including but not limited to a breach of legislation, contractual obligation, duty of care, Code of Conduct, or order of any government or statutory authority), or any proven or admitted criminal conduct; or

- the unlawful possession, sale, supply, use or application of a Prohibited Substance.

-

Bullying or unlawful discrimination

- Any form of bullying or unlawful discriminatory conduct by You.

- Despite Clause 37.1, We will cover You for the cost of any compensation or damages agreed by Us in writing, up to a sub-limit of $15,000, to be paid on your behalf to resolve a statutory conciliation process that arises as part of a complaint against you brought before a human rights or equal opportunity commission.

-

Indemnity elsewhere

- For which You are entitled to indemnity from or have the benefit of an indemnity arrangement with any other entity including an employer, insurer, medical defence organisation, government agency, university, hospital, or education provider.

-

Other healthcare professional

- Any Healthcare provided by another healthcare professional, or any Claims made against You because of any association or arrangement You have with another healthcare professional, except as provided by Clause 7.

-

Fines, penalties, or punitive damages

- The payment of a fine, or civil, criminal, or statutory penalty; or

- punitive, aggravated, additional or exemplary damages.

-

Recovery of money and refund of fees

- Any action in relation to the recovery of money; or

- the refund or waiver of any fees charged by You to a Patient including by agreement or order by an Adjudicative or Determining Body.

-

Public liability

- Any personal injury not arising from the provision of Healthcare; or

- the ownership, use, occupation or state of premises, or the contents of such premises, or anything done or omitted to be done in respect of the state of any premises owned/used/occupied by You.

-

Product liability

- Arising out of the design, manufacture, invention, creation, commercial distribution, or sale of any goods or product including any commercial advice and training in relation to the design, manufacture, invention, or creation of any goods or product, including in relation to clinical trials or research projects.

-

Where You have personally designed, manufactured, invented, or created any goods or product, we will not cover you in relation to any Claims where you have

also prescribed, recommended, promoted, used, or endorsed those goods or product.

-

Property damage

- Arising from loss or damage to property.

-

Business related issues

Circumstances arising from business-related issues that are not directly related to Your provision of Healthcare including:

- any anti-competitive conduct or restrictive trade practices under the ‘Competition and Consumer Act 2010 (Cth)’; or

- the sale of Your practice or business including any debts, guarantees, or contracts for services negotiated as part of the sale; or

- liability arising from Your role as a director/ officer/principal/trustee/associate/ franchisor/shareholder of a trust/company/ partnership/business/franchise; or

- in relation to or any costs, repayments or liability incurred arising from audits undertaken by the Australian Tax Office or the State or Territory Revenue offices(s); or

- liability You assume by contract, waiver, guarantee or warranty; or

- in relation to infringement of a third party’s intellectual property rights.

-

Employment liability

- Any bodily injury, mental injury, sickness, disease, disability, incapacity, death, or property damage suffered, or allegedly suffered by You, or any of Your employees/ contractors/Colleagues/volunteers during Your or their employment/engagement.

- Any matter arising directly or indirectly from/in respect of any unemployment or liability arising under workers compensation, disability benefits, or other similar law.

- Any compensation related to employee entitlements that You, Your employer, or a hospital may be obligated to, or is found liable to pay, including any backpay, remuneration, superannuation, redundancy or benefits, as well as outstanding taxes, fines, penalties and punitive damages.

-

Contagious disease

-

Your transmission of a notifiable contagious disease with which You were infected where You:

- knew or should reasonably have known that You were infected with; or

- failed to comply with an order by any government or statutory authority, for the purpose of limiting the spread of a notifiable contagious disease.

-

Your transmission of a notifiable contagious disease with which You were infected where You:

-

War or terrorism

- War (whether declared as such or not), invasion, act of foreign enemy, terrorism, hostilities, civil war, rebellion, revolution, insurrection or military or usurped power. This exclusion does not apply to the provision of Healthcare to persons injured as a result of any such act or threat.

-

Radioactive materials

- Circumstances arising from ionising radiation or contamination by radioactive materials of any type, except when used in the ordinary course of radiation oncology, radiotherapy, radiology or nuclear medicine by You.

-

Pollution and asbestos

- Unlawful disposal of any waste that introduces contaminants into the environment which have harmful or poisonous effects; or

- Actual, alleged or threatened pollution from, or exposure to asbestos or any materials containing asbestos in whatever form or quantity.

-

Loss of documents

- Loss of/damage to or the failure to properly protect the security of electronic or hard copy Healthcare records.

-

Cybercrime

- Any circumstance that arises out of/in connection to/is contributed to/or results in, either a direct or indirect criminal Cyber Act or Cyber Incident, or fear or threat of a Cyber Act or Cyber Incident.

-

Prescribing of Growth hormone and Anabolic compounds

-

Prescribing of the following drug classes unless you hold specialist endocrinologist or oncologist registration or are following a treatment plan provided by a specialist endocrinologist or oncologist:

-

Growth hormone secretagogues/ mimetics, including but not limited to:

- Growth hormone releasing hormones; or

- Growth hormone releasing peptides; or

- Ghrelin mimetics; or

- Selective androgen modulators (SARMs).

-

Growth hormone secretagogues/ mimetics, including but not limited to:

-

Prescribing of the following drug classes unless you hold specialist endocrinologist or oncologist registration or are following a treatment plan provided by a specialist endocrinologist or oncologist:

-

Non-Therapeutic Goods Administration (TGA) approved intravenous Infusions

- Prescribing or administration of non-TGA approved intravenous infusions outside of an approved clinical trial.

-

Cosmetic genital procedures

- Any cosmetic genital procedure or cosmetic genital treatment.

- Student Members

If you are a Student Member:

- Where You hold Yourself out as a Healthcare Practitioner; or

- where You act in any capacity other than as a student, trainee, or observer; or

- Healthcare You provide that is outside of the terms and guidelines of Your university course or placement, or without required supervision (except for Good Samaritan Acts); or

- where otherwise excluded under Clauses: 30 to 55.

General conditions of this Policy

These conditions apply to You, and if You are a Sole Practitioner, to Your Practice, Practice Staff and locum/temporary healthcare professionals.

You must notify us

As a condition of this Policy You must notify Us of the following:

- As soon as practicable, of any facts or circumstances, of which You became aware, that could lead to a Claim under this Policy. If You do not notify Us of these circumstances, You may not be covered under the Policy and Your right to indemnity may be prejudiced.

- If there are any changes/ additions to any condition, undertaking, notation or endorsement on Your Ahpra registration, or if You receive notice that any registration authority intends to change them.

- In advance of Your travel if You intend to provide Healthcare outside Australia.

Cancellation

MIPS may cancel Your membership by giving You 30 days written notice if:

- At any time, You have failed to comply with a provision of this Policy.

- Prior to entering into this Policy, You made a misrepresentation to MIPS upon which We relied.

- You are paying Your MIPS membership fee in instalments and at least one instalment has remained unpaid for a period of one month.

- You threaten or abuse MIPS staff.

- For any other reason permitted by the ‘Insurance Contracts Act 1984 (Cth)’ or the ‘Medical Indemnity Act 2002 (Cth)’.

A written notice will be sent to Your last known address.

You must tell Us Your correct gross billings/ salary amount

Where You are not indemnified by Your employer, You must supply Us with an accurate estimate of Your gross billings/salary at the beginning of the Policy Period and/or an estimate of Your salary for elements of Your practice where there are no billings generated. You must tell Us if this estimate changes during the Policy Period.

We are entitled to audit Your gross billings/salary and We require You to comply with Our requests for information. If We find that the gross billings/ salary You estimated was not accurate, We may adjust Your membership fee.

If You intentionally supply Us with an inaccurate estimate of Your gross billings/salary, We may void the cover entirely (that is, We may treat the cover as never being of any force or effect).

Continuous cover

If You first became aware of facts or circumstances that may give rise to a Claim, or request for indemnity in a previous Policy Period of Your MIPS membership and You failed to notify Us, then notwithstanding Clause 30, We will extend cover where:

- You have held uninterrupted MIPS membership since You first knew, or a reasonable person in Your professional position could be expected to have first known that the Incident might give rise to a Claim under this Policy; and

- if You had notified Us when You first became aware of the facts or circumstances, under that Policy years’ conditions, You would have qualified for indemnity; and

- Your delay in notifying Us was not fraudulent non-disclosure or fraudulent misrepresentation.

Our liability is confined to the terms of Your cover that was effective when You first became aware of the Incident that may have led to a Claim.

If You are eligible for indemnity under continuous cover, We may reduce Your entitlements by the amount of prejudice Your delay in the notification of the Incident has caused, as determined by Us.

Your duty to cooperate

We require You to cooperate fully with Us, Our investigators, authorised third parties and legal representatives. We require this cooperation to the extent reasonably necessary for Us to assess and manage the defence or representation of the Claim of which We have assumed conduct in Your name or on Your behalf. We also require You to provide Us with accurate information, including Your correct gross billings/salary for Your practice that is not employer indemnified, and by informing Us when this changes.

If You do not provide accurate information as requested, We may reduce Our liability under this Policy (possibly to nil) or cancel Your MIPS membership, or both. If Your non-disclosure is fraudulent, We may be entitled to treat Your membership as it never existed.

Conduct of a Claim

We will have conduct of any Claim and may appoint solicitors to act on Your behalf. You or Your Practice Staff must not admit liability for an Incident or agree to settle a Claim unless You have Our prior written consent. We will consult with You in relation to facts and circumstances that may be contested, and We will seek Your consent regarding any admissions of liability. We otherwise reserve the right to conduct negotiations and settle, defend, appeal, or pursue matters on the best terms and in accordance with legal advice, including any related proceeding for contribution, indemnity, or recovery.

Should You request to pursue an alternative strategy, We will review Your request in accordance with Our dispute resolution process. Should You elect to formally withdraw a Claim for indemnity under this Policy, Our liability to indemnify You in relation to any settlement or subsequent damages awarded for that Claim may be limited to any settlement range and/or Legal Costs determined by MIPS, acting reasonably.

Legal Costs and consent

Legal Costs will only be covered if Our written consent (which will not be unreasonably withheld) is obtained before the costs are incurred. The costs of any appeal will not be covered unless We have given written consent for pursuing an appeal before it is commenced.

If an Incident is only partially covered under this Policy, We will determine a reasonable allocation of Legal Costs which are covered under this Policy.

Withdrawal of indemnity for Legal Costs

We may decide not to incur any further Legal Costs in defending, responding to or pursuing a Claim under Clauses: 11-29 if we believe there are no reasonable grounds for defending, responding to or pursuing the Claim or there are no reasonable prospects of success if we do. We will consider any legal advice in making that decision. If we do that, we will inform you in writing. We will pay the Legal Costs incurred prior to the date on which we write to you telling you of our decision. After this point, You may still conduct the matter at Your own expense. If You are ultimately successful, We will pay (up to an agreed amount and in accordance with any relevant sub-limits) the reasonable Legal Costs You incurred in defending, responding to or pursuing the matter (excluding Goods and services tax (GST) if You are GST registered).

Excesses and other special conditions

Your cover may be subject to ‘special conditions’. This might include an excess, a requirement that You undertake risk education training or the limitation or exclusion of certain procedures.

Should We determine that an excess or special condition applies, We will inform You in writing when You apply or are about to renew. The excess/es or special condition/s will be shown on Your Member Benefit Statement. Any excess will need to be paid within 21 days of Our written request.

If You fail to pay the excess on or before the due date, We may reduce the amount We pay towards Your Claim by the amount of the excess and any prejudice We have suffered because of Your non-payment of the excess by the due date.

Recoveries

If Legal Costs are awarded to You from another party or insurer in relation to a Claim, We reserve the right to recoup from You those costs incurred in the defence or pursuit of that Claim. Where You have paid an excess, Your excess (or part thereof) will be reimbursed to You in proportion to Your relative contribution to the total Legal Costs incurred on Your behalf for that Claim.

If We make a payment or incur Legal Costs in the defence or pursuit of a Claim under this Policy, We reserve the right to recoup those costs, or seek contribution, indemnity or recovery from another party or insurer without the need for Your consent. You must not settle any claim for contribution, indemnity or recovery without Our prior written consent.

Appeals

If You are dissatisfied with the outcome of a Claim, You can request that We assist You with an appeal. You must set out in writing Your reasons for wanting to bring an appeal. We will assess whether there are reasonable prospects of success and if Your Legal Costs will be covered by Us. We will respond to you in writing. Strict time limits for lodgment of the appeal may apply.

If We do not agree to cover You in the pursuit of an appeal, You may still conduct the appeal at Your own expense. If, in doing so, You are ultimately successful, We will pay (to an agreed amount and in accordance with any relevant sub-limits) the reasonable Legal Costs You incurred in pursuing the appeal (excluding GST if You are GST registered).

Cessation of specified Healthcare activities

You must agree to stop providing or carrying out a specific procedure or treatment (clinical activity) if it is determined:

- By Us that the treatment, procedure or practice poses an unreasonable risk of an Incident occurring.

- That a registration board, professional body, or specialist college does not endorse such treatments, procedures or practices.

- That an educational body, a Healthcare facility, a supervisor, or Your employer does not endorse Your provision of such treatments, procedures or practices.

You will have a maximum of 14 days to cease the specified clinical activity from the date You are notified by the relevant party, unless instructed to do so earlier. After this time period has lapsed, We will no longer cover You for Claims arising from that clinical activity. If You subsequently continue to carry out that clinical activity, We will cancel Your membership with 30 days’ written notice.

Definitions

Adjudicative or Determining Body includes but is not limited to, a court, tribunal, commission, coroner’s court, special commission or inquiry, agency and entity under the Health Practitioner Regulation National Law including a national board, board, tribunal, panel, committee and professional council.

AFSL means Australian Financial Services Licence.

Ahpra means Australian Health Practitioner Regulation Agency.

AMC means Australian Medical Council.

APPs means Australian Privacy Principles.

APRA means Australian Prudential Regulation Authority.

Asynchronous Telehealth means Patient interactions that are solely by means of transmission of images and/or data where there is no real time interaction with the Patient that is face-to-face or via audio or video communication.

Australia means, when referring to a specific practice location, the Commonwealth of Australia and its external territories. It does not include embassies, consulates, high commissions and/or other similar sites operating in sovereign nations. For the avoidance of doubt these locations are considered overseas territories.

Claim means any request for indemnity that is covered under this Policy in relation to an Incident.

We regard each of the following as a single Claim:

- All Claims arising from Your provision of Healthcare to any one Patient.

- All Claims arising from Your provision of Healthcare to any one childbearing person and their unborn child/children or newly born child/children.

- All Claims by one or more claimants arising from any one Incident or any one series of related Incidents arising from Your provision of Healthcare.

- All such Claims constituting a single Claim will be deemed to have been first made on the date on which the earliest single Claim was first made, regardless of whether such date is before or during the Policy Period.

Colleague means any natural person other than a Patient where there is, or has previously existed, a professional relationship arising out of Your provision of Healthcare.

Commencement Date means the first date on which you held MIPS membership that is uninterrupted with your current Policy Period.

Continuous Cover Period means the membership term that commences on the Commencement Date and continues to the end of the current Policy Period.

CPD means Continuing Professional Development.

Cyber Act means an unauthorised, malicious or criminal act (including cybercrime) or series of related unauthorised, malicious or criminal acts, regardless of time and place, involving access to, processing of, use of or operation of any Cyber System.

Cyber Incident means:

- any error or omission or series of related errors or omissions involving access to, processing of, use of or operation of any Cyber System; or

- any partial or total unavailability or failure or series of related partial or total unavailability or failures to access, process, use or operate any Cyber System.

Cyber System means any computer, hardware, software, communications system, electronic device (including, but not limited to smart phone, laptop, tablet, wearable device), server, cloud or microcontroller including any similar system or any configuration of the aforementioned and including any associated input, output, data storage device, networking equipment or back up facility, owned or operated by You or any other party.

Employment Dispute means:

- allegations, complaints or proceedings under unfair dismissal, discrimination, equal opportunity or human rights legislation; or in relation to a breach of employment contract; or

- in relation to Clause 19.1 an allegation by You of a lack of procedural fairness in relation to a decision which has resulted in a mid-term suspension, limitation or revocation of Your credentialing with a hospital or health service, either as an employee of the hospital or health service or under a contract of service you have the hospital or health service.

Good Samaritan Act means Healthcare provided by You voluntarily and without remuneration in relation to an emergency where You would not normally be expected to be available to provide Healthcare.

Gratuitous Services means Healthcare provided by You where You received no remuneration or other reward and Patients or others were not charged for Your services including prescribing, writing referrals and volunteer services.

Healthcare means:

- any consultation, interaction, support, treatment, advice, or service provided for the physical or mental health of a Patient; or

- supervising, educating, and training of others in their provision of Healthcare; or

- education or training You undertake to enable Your current or future provision of Healthcare; or

- any health-related examination, report or opinion prepared by You at the request of a third party, such as a lawyer, insurer or statutory body; or

- Your provision of health system management, health-related research, or health-related advice; or

- other activities You undertake for which Ahpra requires You to maintain registration; or

- other activities which MIPS has agreed in writing will be covered under this Policy.

In the case of Student Members, the above clauses do not apply, and the definition of Healthcare is limited to Patient interactions that occur while You are undertaking a healthcare placement, or elective as part of a university course or degree, that is required for You to qualify as a registered Healthcare Practitioner. For international medical graduates, this includes activities related to any observerships You are required to undertake to obtain Ahpra registration.

Healthcare Practitioner means an individual who practices in an Ahpra registered profession.

Incident means any actual or alleged act, error, omission or circumstance that occurs in the course of, or in connection with Your provision of Healthcare.

Legal Costs means the reasonable and necessary legal fees, disbursements and related expenses that We incur in relation to the defence, pursuit or settlement of a Claim or otherwise representing You in relation to a Claim accepted under this Policy. Legal Costs do not include the cost of any appeal unless otherwise agreed in writing with Us.

Member Benefit Statement means the most recent statement issued to You referencing this Member Handbook.

Membership Classification Guide means Section 06 of this document.

MIPS/MIPS Insurance/Us/We/Our means Medical Indemnity Protection Society Ltd. (ABN 64 007 067 281) and its subsidiaries including MIPS Insurance Pty Ltd (ABN 81 089 048 359).

Patient means a person who has received or is receiving Healthcare from You.

PDS means Product Disclosure Statement.

Policy Period means the start and end date shown on Your most recent Member Benefit Statement, but the Policy Period will end when you cease to be a member of MIPS if that occurs before the end date.

Policy means the Indemnity Insurance Policy, Membership Classification Guide, and Your Member Benefit Statement issued by Us. Policy includes all documents that provide terms, conditions, definitions, exclusions, endorsements, or extensions and includes this Policy wording and any amendments to this wording.

Practice Staff means a person employed directly or indirectly by You to the extent that they assist You to provide Healthcare to Your Patients including administrative staff, practice managers, nurses, and dental assistants.

Prohibited Substance means drugs or compounds banned by a regulatory agency or where drugs or compounds are used at unlawful concentrations.

Retroactive Cover Date means the date on or after which the Healthcare must have occurred to be covered under this Policy. It is shown on Your Member Benefit Statement.

ROCS means Run-Off Cover Scheme.

Sole Practitioner means You operate and control a single practice entity for the purpose of providing Healthcare, You are the sole registered Healthcare Practitioner within that practice and are a beneficial owner of the practice. Your beneficial ownership of the practice can include direct ownership, joint ownership or ownership via a trust, company, partnership or business but does not include franchise arrangements or ownership through a corporate entity that is within a corporate group comprising multiple corporate entities.

Student Member means a member of MIPS in the ‘Healthcare student’ or ‘Observership only (pre-registration)’ category in the Membership Classification Guide.

Telehealth means Healthcare provided by You where the means of delivering Healthcare involves the transmission of audio, video, images and/or data between You and a Patient. This may occur in real time. However, where it does not occur in real time, We separately define this as Asynchronous Telehealth.

TGA means Therapeutic Goods Administration. USA means United States of America.

You/Your/Yourself means the Healthcare Practitioner named as the insured on the Member Benefit Statement for this Policy.

Section 03

How your cover works

Claims made cover

Australian medical indemnity insurers must provide ‘claims made’ cover. This means that cover is provided for claims and notifications that are made or first notified to us during the policy period.

This means cover will apply if:

- you hold a current MIPS membership at the time the incident is reported to us; and

- the incident giving rise to the claim occurred on or after your retroactive cover date; and

- the actual litigation or complaint made against you does not arise until some point in the future.

Should a claim or complaint be made against you, or you are the subject of an investigation, make MIPS your first call to ensure any notification falls within your policy period – and we will provide you with the guidance you need.

What is my retroactive cover date?

Claims can arise years after an incident occurred. Aphra requires all healthcare practitioners have ‘retroactive cover’ i.e. cover against otherwise unknown claims relating to your prior practice in Australia.

If you have held a ‘claims incurred’ policy prior to 1 July 2003, your retroactive cover date should be the end date of that policy. If you have been employer indemnified for any period after 1 July 2003, your retroactive cover date should be the earliest date you commenced practice that was not indemnified by your employer.

This policy will cover you for incidents arising out of healthcare provided after your retroactive cover date. This date is shown on your Member Benefit Statement. We do not cover you for healthcare provided prior to your retroactive cover date or matters previously known to you, or your past indemnity provider(s).

Please contact us if you require assistance to determine the appropriate retroactive cover date for your practice.

Run-off cover

Claims can arise at any time. When you (temporarily or permanently) stop practising healthcare in Australia, it’s important to maintain cover for potential claims that may arise in

the future based on your past practice. Ahpra requires you to have this ‘run-off cover’ if you decide to take a sabbatical, go on maternity leave, move countries, or retire.

You’ll find more information and guidance in ‘Section 06: Membership Classification Guide (Ceasing practice in Australia)’. If you cease practising in Australia, complete the Ceasing Practice form at mips.com.au/forms

I am indemnified by my employer – do I still need insurance?

If you have indemnity provided by your employer, you might be wondering if you still need insurance. It is important to check what’s provided, as cover may be limited to claims arising from your civil liability only.

While cover for civil claims is the only cover required by Ahpra to meet its requirement for holding appropriate professional indemnity insurance, the indemnity provided by your employer, might not cover you for Professional and Disciplinary matters, Employment, Training Program and University Disputes or Pursuit Matters as outlined in the Indemnity Insurance Policy.

*See definition here.

Section 04

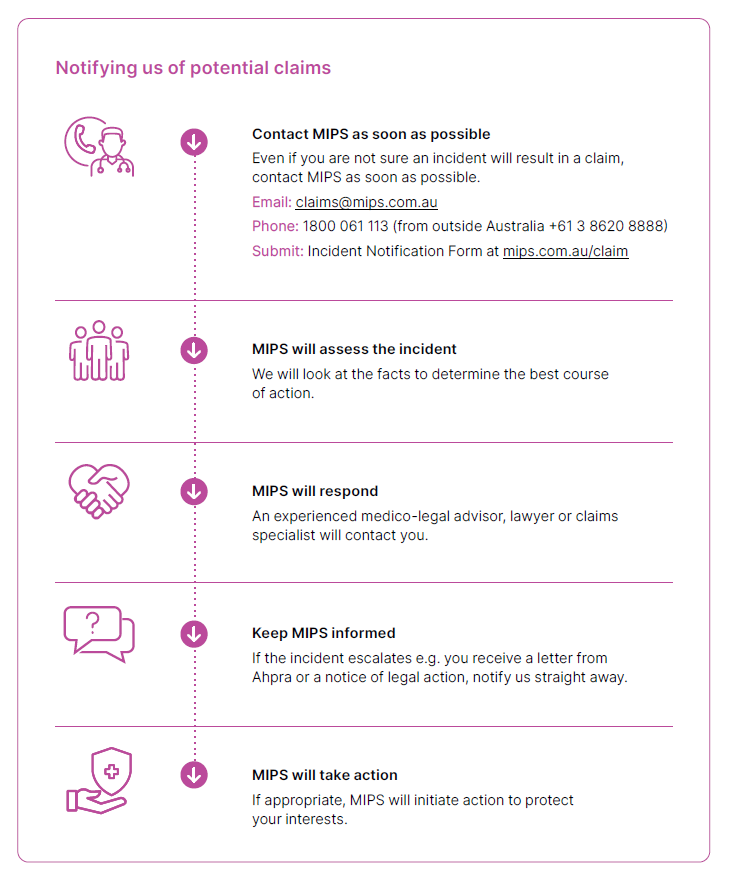

How to make a claim or notification

How to notify us

If you are concerned about an incident or circumstance that could lead to a claim, notify us as soon as possible. Your cover and right to indemnity depend on the timely sharing of information.

Your full rights and obligations in the event of a claim, along with the process MIPS will follow, are set out in ‘Section 02: Indemnity Insurance Policy ’ and can also be found online at mips.com.au/publications

We are here for you 24/7

You can contact us at any time for advice and support even before a claim arises. We encourage you to check in with us, even if it is just for peace of mind.

MIPS Member Advice and Support Line: 1800 061 113 (from outside Australia +61 3 8620 8888).

Keeping in touch

We will keep in contact with you primarily by email to ensure you receive the information you need quickly and conveniently. We’re also just a phone call away if you need to speak with us directly.

To aid our communication, please keep all your contact details up to date via the ‘ My Membership’ portal online or alternatively call us on 1800 061 113 (from outside Australia +61 3 8620 8888).

Section 05

Other information you need to know

How to make a complaint

MIPS is committed to dealing openly and efficiently with all member feedback and complaints. If you are not satisfied with our products or services, or a decision made in relation to your MIPS membership, please let us know so we can help.

To help to address your complaint effectively, it is important that you follow the process outlined below.

Step 1: Contact MIPS.

It is often possible to resolve issues by simply contacting MIPS Member Services. If necessary, we may refer your complaint to a more appropriate contact at MIPS, to ensure you are dealing with the right person. A response is usually provided to you within five business days.

MIPS Member Service

Phone: 1800 061 113

(from outside Australia +61 3 8620 8888)

Email:

complaints@mips.com.au

Address: MIPS, PO Box 24240, Melbourne VIC 3001

Step 2: Refer your complaint for review.

If you are not satisfied with the outcome of your complaint, you can request the complaint be referred to the Internal Dispute Resolution Manager who will conduct an independent review of the matter. The manager will respond to your complaint within 30 calendar days of the complaint, provided they have all the necessary information to complete their review. If we need more information or need to undertake further investigation, we will agree with you a reasonable alternative timeframe. When a decision about your complaint has been made, we will notify you of our decision in writing, setting out the reasons for our decision.

MIPS Internal Dispute Resolution Manager

Phone: 1800 061 113 (from outside Australia +61 3 8620 8888)

Email:

complaints@mips.com.au

Address: MIPS, PO Box 24240, Melbourne VIC 3001

Step 3: External dispute resolution.

We expect our procedures and staff will deal with your complaint fairly and promptly. However, if you remain dissatisfied, you may be able to access the services of the Australian Financial Complaints Authority (AFCA), an independent external dispute scheme.

Australian Financial Complaints Authority

Website: www.afca.org.au

Phone: 1800 931 678 (from outside Australia +61 1800 931 678)

Email: info@afca.org.au

Address: Australian Financial Complaints Authority, GPO Box 3, Melbourne VIC 3001

How do I cancel my membership?

A cooling off period, for peace of mind

You have a 30-day cooling off period for your MIPS membership every policy year. If you cancel your membership within the cooling off period, the membership fee you paid will be refunded provided you haven’t made an incident notification with MIPS.

The option to cancel, with reasonable terms

You may cancel your membership for any reason by providing us with one days’ notice.

If you cancel your MIPS membership outside the cooling off period, we will refund the value of your membership fee from the day we receive your cancellation request (or a future date requested by you before the next renewal date), minus an administration fee of 20% of that refund, or $50 – whichever is greater.

For members paying via direct debit instalments, there may be an outstanding balance to pay, depending on your chosen cancellation date. Please contact us for an estimate before you cancel your membership.

All membership benefits including insurance cover end the date that your membership is cancelled. Be sure to notify us of any incidents that may result in a claim before you cancel your membership, as these may be covered by MIPS.

If your membership lapses due to non-payment or is cancelled, you might be in breach of your legal obligations to have appropriate professional indemnity insurance arrangements in place.

Financial Claims Scheme

The Indemnity Insurance Policy may be a ‘protected policy’ for the purposes of the Federal Government’s Financial Claims Scheme (FCS). The FCS is administered by the Australian Prudential Regulation Authority (APRA). MIPS Insurance, a wholly owned subsidiary of MIPS, is authorised by APRA. In the unlikely event that an insurer authorised by APRA becomes insolvent, the Federal Treasurer may make a declaration that the FCS applies to that insurer. If the FCS applies, you may be entitled to have valid claims paid under the FCS. Access to the FCS is subject to eligibility criteria.

Information about the scheme can be obtained from the APRA website at www.fcs.gov.au and the APRA hotline on 1300 55 88 49 (outside Australia +61 2 8037 9015).

Section 06

Membership Classification Guide

Understanding your membership classifcation

To meet your Ahpra obligations, it is mandatory to have appropriate professional indemnity insurance in place for all aspects of your practice. To do this, you must ensure that your membership classification covers all the healthcare you provide and need cover for.

The purpose of this section is to provide you with an overview of the different elements of your membership classification to ensure your cover is tailored to the healthcare you provide.

Your classification comprises of your Category, Practice Basis, Practice State and Endorsements and an estimate of your level of Billings, Salary, and Hours (if applicable). Together, these determine the healthcare that is covered by MIPS. More information on each element of your membership classification is provided below. You are required to accurately provide this information to us.

Category

Your category is based on your Ahpra registration.

If you are a medical or dental practitioner, a specialist category will apply if:

- you hold a specialist registration with Ahpra; or

- you are undertaking a specialist training program; or

- you have a specialist qualification outside of Australia and you are practising under supervision before obtaining your Ahpra specialist registration.

If your specialty has more than one possible category (e.g. procedural or non-procedural), the category selected will be based on the treatments and procedures you undertake where you are not employer indemnified or under supervision. These treatments and procedures are listed under each respective category but are not exhaustive and may change from time to time. You must ensure that different procedures and treatments you perform are not excluded under your category.

Where you hold more than one Ahpra registration (e.g. both medical and dental), the category will be based on your practice that is not indemnified by your employer that carries the higher risk, as determined by MIPS.

Practice basis

Your ‘Practice basis’ describes the type of practice you undertake. For example:

- If your practice is employer indemnified, not employer indemnified, or a combination of both.

- If you have obtained specialist registration, or you are currently undertaking or enrolled in a specialist training program.

- If you have completed your healthcare studies within the last five years.

- If you undertake practice that requires an endorsement.

Employer indemnified practice

Employer indemnified practice is where your employer has agreed to indemnify you for any civil claims arising from your provision of healthcare. This usually applies to practice undertaken in a public healthcare setting, although it may also apply to a private setting.

If you are uncertain of your indemnity arrangements, you should seek advice from your employer. Medical practitioners employed under contract in the public hospital system can contact the Australian Salaried Medical Officers Federation for advice regarding the indemnity provided under their contract.

Even if your employer provides indemnity for civil claims, your employer’s indemnity may not extend to other types of claims. In this situation, MIPS provides cover to you for professional and disciplinary matters, coronial investigations, certain types of employment and pursuit matters.

You may approach MIPS for assistance if you have concerns that your employer is not meeting or is unable to meet their obligations to you (e.g. due to conflict of interest).

The ‘Employer indemnified only’ Practice Basis may be appended to your classification if your practice is solely employer indemnified. All members undertaking practice that is indemnified by their employer are eligible for this cover.

Estimating billings, salary and hours

A ‘billings/salary’ or ‘hours’ band may be appended to your Practice basis if you require cover for practice that is not employer indemnified.

You are required to provide an estimate of your annual gross billings for all practice not indemnified by your employer. Note that this is not the same as the income you receive.